Economic & Community Development

Economic & Community Development

Giving Business the Edge!

Scott Perkins, Director

Economic & Community Development

voice 207-848-1010

cell 207- 852-2403

Mission Statement

Hermon is a growing community made up of young families, educated professionals, business owners and long term residents that anchor our Town. Hermon experiences a quality workforce available locally and regionally due to our unique geographical advantage. Our Town offers some of the best locations for business regionally. Multiple transportation options include the Interstate system, Bangor International Airport and Railway service extending from Canada to Searsport.

An exceedingly low tax rate is common in Hermon with rates often times half as much as neighboring communities. These supports have created a strong local business base that takes advantage of the qualities that a well planned community can provide.

Hermon provides an extremely high quality of life for families of all ages. The Town is a State wide leader concerning the delivery of quality municipal and business services. Hermon offers good recreational opportunities and strong support for its schools. An identified strength for Hermon remains its ability to encourage commercial growth in areas that do not interfere with its suburban and rural appeal.

With responsive administrative leaders, quality educational opportunities and public safety resources that exceed most communities our size, Hermon is a complete package for any business owner looking for excellence in municipal service and steady positive growth for its bottom line.

Loans & Assistance Programs

Camden National Bank Fixed Asset Loan Subsidy

The Town of Hermon wishes to encourage establishment and growth of business enterprises now existing or wishing to locate in the Town. For this purpose, it has established a fund for the purpose of subsidizing interest payments on business loans made by Camden National Bank to qualified business enterprises within the Town.

Need more details? Call the Hermon DECD Office:

Scott Perkins

207-848-1010 (office)

Government Resources- State of Maine Department of Economic & Community Development

Industrial development bonds:

The Finance Authority of Maine (FAME), as well as municipalities in the state, issues bonds to provide tax-exempt financing for private businesses. Proceeds may cover the cost of land, land improvements, utilities, buildings, engineering, architectural and legal fees, and machinery and equipment.

Loan guarantees:

The Commercial Loan Insurance Program insures up to 90 percent of a loan to a maximum loan insurance exposure of $4.25 million. 100 percent insurance available for loans to veterans, oil storage facility projects, clean fuel vehicle projects, and waste oil disposal site cleanup projects. Loan proceeds may be used for purchase of – and improvements to – real estate, machinery, and equipment.

Direct lending:

The Economic Recovery Loan Program is a direct lending program designed to help small businesses remain viable during difficult economic times. Existing businesses may apply. In considering loan applications, FAME looks to support creditworthy projects demonstrating substantial public benefit that have utilized other sources of capital.

The program is meant to be a lending program of last resort after a business has exhausted conventional lending sources. Loans may not exceed $200,000, except in cases where substantial public benefit exists. The interest rate will not exceed Wall Street prime plus 2 percent. Terms may be structured to meet the borrower’s specific needs.

Economic Development Grant Programs-State of Maine DECD:

Grants to Municipalities: for acquisition, relocation, demolition, clearance, construction, reconstruction, installation, and rehabilitation associated with public infrastructure projects such as water and sewer facilities, flood and drainage improvements, publicly-owned commercial and industrial buildings, parking, streets, curbs, gutters, sidewalks, etc. All public infrastructure must be owned by the municipality or public or private utility and be in support of an identified business. Maximum award: $1,000,000.

Grants to Municipalities for Direct Business Support: for capital and non-capital equipment, land and site improvements, rehabilitation or construction of commercial or industrial buildings, job training, working capital and capital equipment and be in support of an identified business. Acquisition is not an allowable activity under this group. Maximum award: $1,000,000.

Workforce Development Grant Program (WDG)-State of Maine DECD:

Grants to municipalities to address community and business resource needs by providing funding for operating expenses, equipment, and program materials for workforce training programs which will benefit low/moderate income (LMI) persons. Eligible activities include operating and program material expenses for the purpose of providing workforce training and skills development to address the shortage of an available trained workforce. Other eligible public service activities associated with the project are allowed. Maximum award: $100,000.

Micro-Enterprise Assistance Grant Program-State of Maine DECD:

Grants to Municipalities for Direct Business Support to assist in innovative solutions to problems faced by micro-enterprise businesses. Assistance to businesses may be in the form of grants or loans at the discretion of the community. Eligible activities under the Micro-Enterprise Assistance category are grants or loans to for-profit businesses that can be used for working capital and interior renovations, facade grants or loans for exterior improvements, including signage, painting, siding, awnings, lighting, display windows and other approved improvements; and eligible planning activities necessary to complete the project development phase. Maximum award: $150,000.

Tax increment financing (TIF) – State of Maine & Town of Hermon:

Local governing bodies can designate areas in their municipalities as development districts to facilitate redevelopment activities. Public financing, usually in the form of bonds, provides necessary improvements, and developers obtain financing to carry out the major redevelopment. The public debt is retired through the increase in property taxes generated by the redevelopment.

Employment tax increment financing (ETIF):

This program provides project financing to businesses that add five or more employees at wages above the county average and provide access to health insurance and a retirement program. The amount of financing is based upon state individual income tax withholdings and is available for up to 10 years.

Pine Tree Development Zone Program:

This program uses a combination of tax incentives to spur economic development statewide. The state will offer to qualified new and expanding businesses (1) an enhanced employment tax increment financing that returns 80 percent of the state income taxes withheld from qualified net new employees for up to 10 years; (2) a 100 percent refund of corporate income tax and insurance premium tax for years one-five, and 50 percent for years six through 10; (3) a 100 percent sales tax exemption for construction materials and equipment purchases; (4) a 100 percent sales tax reimbursement on real property purchased and/or physically incorporated; and (5) access to reduced electricity rates.

Workforce Training Programs

Maine Quality Centers:

The Maine Quality Centers, administered by the Maine Community College System, provide a pre-trained, competitively tooled workforce for new or expanding Maine businesses that create at least eight full-time jobs with benefits. The education and training, provided at no cost to the company, is fast-track, guaranteed, and customized to an employer’s specifications.

Maine Apprenticeship Program:

This program is a customized, systematic training program designed to meet the needs of Maine employers through on-the-job training and related classroom instruction. The program may reimburse the apprentice (or employer if the company is providing tuition assistance) for up to 50 percent of tuition for college credit courses. At the end of the program, an employer has a certified, skilled journeyperson.

Maine State Contact:

Maine Department of Economic and Community Development

59 State House Station

Augusta, ME 04333-0059

(207) 624-9800

http://www.maine.gov/decd/

- Community Development Block Grant CDBG Program

The CDBG Economic Development Program provides gap funding in the form of grants and loans for communities to assist businesses in the creation/retention of quality jobs for low and moderate-income persons. Program activity groups, maximum grant and loan amounts may be reviewed at: http://www.maine.gov/decd/meocd/cdbg/

- Finance Authority of Maine

FAME offers a wide array of business assistance programs, ranging from traditional loan insurance programs for both small and larger businesses, to investment tax credits. FAME has also established taxable and tax-exempt bond financing programs that allow strong, creditworthy firms in Maine to access capital at favorable rates and terms. http://www.famemaine.com/

- Maine and Company

Maine & Company provides free and confidential consulting services to businesses looking to relocate to Maine or expand within Maine. Services include real estate site searches, data collection and analysis, incentives identification and valuation, site visit coordination, workforce analysis, and financing coordination. http://maineco.org/how-it-can-work-for-you/

- Eastern Maine Development Corporation

EMDC provides a rich array of programs administered by dedicated professionals to assist business. Services include connecting business with start-up loan opportunities, business plan development, workforce training programs, legal and finance consultations. http://www.emdc.org/

- Small Business Administration

Financial assistance for new or existing businesses through guaranteed loans made by area bank and non-bank lenders. Free counseling, advice and information on starting, operating or expanding a small business through SCORE – Counselors to America’s Small Business, Small Business Development Centers (SBDC) and Women’s Business Centers (WBC). https://www.sba.gov

- Maine Small Business Development Centers

The Maine SBDC program helps build and strengthen small businesses through business advising, training and educational resources. Certified business advisors provide guidance on topics such as business feasibility, business plan development, capital acquisition, financial management, marketing and sales, e-commerce, customer service, personnel management, small business strategic planning and more. The Maine SBDC is a program of the U.S. Small Business Administration, the Maine Department of Economic and Community Development and the University of Southern Maine. http://www.mainesbdc.org/

- Maine Angels

The Maine Angels are accredited private equity investors who help entrepreneurs by investing in and mentoring early stage companies. Our goal is to make sound investments in promising New England entrepreneurs with an emphasis on Maine businesses. http://www.maineangels.org/

Partners & Links

State Government

- Department of Labor

- Maine Quality Centers

- Department of Environmental Protection

- Maine Revenue Services

- Department of Professional and Financial Regulation

- Secretary of State

- SafetyWorks! Program

- Department of Agriculture, Conservation & Forestry, Quality Assurance & Regulations Division

Federal Government

- Small Business Administration

- USDA-RD

- Maine Small Business Development Centers

- Small Business and Self-Employed Tax Center

County Information

Regional Economic Development Organizations

- Androscoggin Valley Council of Governments

- Kennebec Valley Council of Governments

- Greater Portland Council of Governments

- Eastern Maine Development Corporation

- Midcoast Economic Development District

- Southern Maine Planning & Development

- Northern Maine Development Commission

- Western Maine Economic Development Council

- Piscataquis County Economic Development Corp.

Independent Organizations

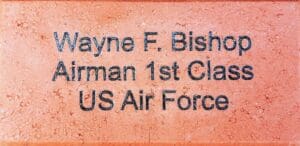

Purchase Veteran’s Memorial Brick

To order a Veteran’s Memorial Brick, please click on the link below to access the form:

4×8 Individual Text Only Brick Order Form-FINAL 9-14-2021